We Aren’t Going to Save Our Way Out of Our Financial Dependency

The allure of financial freedom is strong. Who doesn’t want to have income coming in while they sleep? Who doesn’t want passive income that doesn’t require a 9 to 5 routine? Who would like to make decisions without really considering how much money it would cost?

The idea of controlling assets that would put money into your pocket every month with little effort on your part is indeed appealing. After all, it does appeal to our lazy side. We could go on trips, vacations, travel to exotic places. Or whatever strikes our fancy we could enjoy.

Would that be fulfilling? Would a life of self-indulgence be worth the effort, even it wasn’t much effort at all? Enjoying exotic places might be a great reward for achieving an important goal, but a life without a greater purpose is a wasted life. We were created to build, to create, to make this world a better place, to usher in God’s kingdom here on earth, to raise children who look to their Creator as Lord and Savior, who also live with the same purpose in their generation. We were created to use our wealth and resources to do good, to be generous, and to trust in God, not in our riches.

As the Apostle Paul instructed Timothy,

“Command those who are rich in this world’s goods not to be haughty or to set their hope on riches, which are uncertain, but on God who richly provides us with all things for our enjoyment. Tell them to do good, to be rich in good deeds, to be generous givers, sharing with others. In this way they will save up a treasure for themselves as a firm foundation for the future and so lay hold of what is truly life. (1 Timothy 6:17-19, NET Bible)

So, having a strong life purpose and using the resources of this world to accomplish that purpose is indeed what our goal is what we are about here at Pursuing True Wealth.

But, in our generation, the wealth equation for the average person in the USA has gotten even harder. Now, just to own your own house and achieve some financial stability is a distant dream to many, let alone financial freedom.

It used to be, may more than 50 years ago now, that a man could work for a company, earn a decent living, buy a house and have money for retirement all while having his wife stay at home to raise the children. Life in the USA was comfortable, somewhat predictable, and provided a “good life” for the middle class.

With the women joining into the workforce after World War II families had more disposable income. But the competition for limited goods gave rise to increased prices. Houses that a man could get a mortgage on with one income became unattainable without 2 incomes, because more and more families had two incomes. It is just supply and demand. Then, with the expanded use of credit and time payments for nearly commodity the price of nearly everything increased. Big ticket items like houses and cars have become insanely expensive, especially for young men and women wanting to start a family.

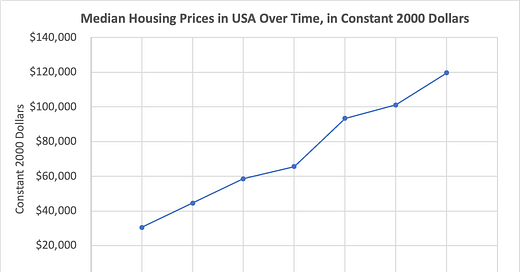

Here is an interesting chart showing the price of housing since 1940, with the prices given in constant year 2000 dollars. So, the prices in the graph are what they would have cost in terms of the value of the dollar in 2000.

A median sized house in the 1940s would have cost about $2,938 (about $30,600 in year 2000 dollars). This median house price has risen 4-fold in the 60 years shown in this graph. And housing prices have changed a lot, about double, in the last almost 25 years as well. So, this shows about an 8-fold increase in housing prices from 1940 until 2023.

Here is a graph showing what $100,000 in 1967 would purchase in each year since then. Basically, the prices have changed 10-fold since then. $100,000 in 1967 is now worth upwards of $1,000,000 in 2023. These numbers are based on the US Bureau of Labor statistics for consumer pricing index for housing.

Of course, we have come to expect that housing prices generally increase every year, even by the government’s numbers. Only in the year 2010 did the consumer pricing index for housing fall a little bit.

From the first graph we saw that housing prices rose about 4-fold from 1940 to 2000. Since 2000 the housing prices have almost doubled again. So, the two graphs point to a consistent trend in an 8- to 10-fold increase in housing prices, in constant dollars. You might argue that our houses are way better than they were in 1940, too, so it is worth it. But how do you pay for them? Have wages kept up with housing costs? Not at all.

Now, I found a graph showing wages over time, again in constant dollars.

The graph makes it look like there has been substantial change over time, but the vertical scale on the Y-axis only goes from $8 to $26 an hour. So, from 1940 (~$9/hr in current money) to 2020 (~$25/hr) is a 2.8-fold increase. But most of that increase was from 1940 to 1970. In the last 50 years it has changed about $3/hour, a miniscule amount.

So, from 1967 to 2023 the housing prices have increased 10-fold while wages have increased about 14%. Not double, not even 50% more. Just a tiny bit on average. Since we are dealing with averages over a long period of time there are plenty of individual exceptions, but society on the whole has been put into a real pinch. The main point here is that housing prices have far, far outstripped wages over time. So, housing has become less and less affordable in the USA, and acutely so in the last couple of years. We could debate and argue about why this has happened, but it is what it is and we can’t just change the situation now, so we have to figure out how to accomplish our purpose given the current situation.

So, working for someone else who pays you wages, benefits, and maybe retirement someday won’t enable you to buy a house, afford reliable automobile transportation, or give your family any financial security. You can kiss vacations good-bye. Visit exotic places? Forget it. Maybe you can look at them on Google Earth, or use some virtual technology to “visit” unseen places. But the average guy in the USA society has gotten poorer in the last 50 years.

And thinking of a bigger purpose and using the resources of the world to accomplish it on your way to True Wealth is out of the picture.

Clearly, we have to do something different. If you save some of your meager wages and think you will pay cash for your first house you are living in the wrong generation and wrong time. That time has passed. Sure, maybe if wages and housing prices were comparable to what they were in 1960 you might have a chance at it.

No, we have to think different, we have to act different. Kris Krohn’s has given advice to get a side hustle that enables you to save and invest $50,000 a year. That $50,000 enables you to buy physical assets that put money into your pocket. It could be businesses that you own while someone else operates them for you. It could be the purchase of a successful, profitable business from someone who is retiring or just moving on to the next thing. They need someone else to operate it and they want to cash out. The prices for business are often in the range of 2-3 times the amount that the owner takes home annually. So, it is possible for the business to literally pay for itself with some short-term financing.

We must do more than just be the boss and work for ourselves. No one needs another job. We need to leverage our time using technology so that we can free up our own time. In business we must design businesses that have systems and processes that don’t require a lot of specialized human input to make the business work. Artificial intelligence with ChatGPT can multiply one person’s labor significantly, though it can’t clean a house or run a saw or build a house. But there are a lot of machines that significantly reduce labor. And AI is getting better and better at doing a lot of the menial computer work for us. It is revolutionary.

It is no longer time to just go interview for jobs and collect a paycheck. That won’t get us to where we want to go. There are great skills to learn working for a paycheck, and some of my children have done so quite well, but it isn’t a long-term solution.

So, here we go. How about you? You have seen the economics around you, and you have had to pay for rent or for mortgage. You have seen what young house buyers are up against. What is your plan?

And next time I will share with you what I am doing.